STOP THE BLUE ANT TAKEOVER OF THUNDERBIRD

Thunderbird shareholders are being asked to exchange a strong, growing, creator-driven company for illiquid stock, rigged vote mechanics, a deflated valuation, and a buyer dependent on a Fairfax cash rescue.

You deserve better.

Executive Summary: This Isn't a Merger. It's a Takeunder.

Under the Plan of Arrangement with Blue Ant, Thunderbird shareholders face:

- Only a nominal "premium" to a depressed pre-announcement share price

- No premium to where the stock traded a year ago

- A price far below prior expressions of interest, including those reportedly above $5

- No collar, no floor, and no guaranteed value

- A capped $40M cash pool that may force you into illiquid Blue Ant shares

- Loss of all meaningful voting rights due to Blue Ant's dual-class structure

- Integration into a company that only exists today because of a $75M+ Fairfax bailout

- $7M of "synergies" — achievable only by cutting Thunderbird jobs

- Permanent subordination to Blue Ant's founder, even though Thunderbird provides most of the creative engine

Thunderbird isn't being valued for what it is.

It's being valued for what Blue Ant thinks it can extract from it.

A Former Blue Ant Executive Led the Committee Evaluating a Sale to Blue Ant

The chair of Thunderbird's strategic review committee, Asha Daniere, was appointed by Voss Capital.

Her background:

- Executive Vice President, Business & Legal Affairs, Blue Ant Media (2012–2020)

- Continued as Strategic Legal Advisor to Blue Ant after 2020

- Then placed on Thunderbird's board

- Then made chair of the committee evaluating a sale to Blue Ant

These facts speak for themselves.

Shareholders can reasonably question whether:

- The process was unbiased

- Alternative bids were adequately explored

- She could independently negotiate against her former employer

- The committee could truly maximize value for Thunderbird shareholders

No allegations — just facts that raise serious concerns.

Did Voss Capital Maximize Value — Or Capitulate?

Voss Capital:

- led the activist push,

- gained board seats,

- appointed Asha Daniere (a former Blue Ant executive),

- then signed a Voting Support Agreement forcing a vote FOR the deal

- and AGAINST any superior offer.

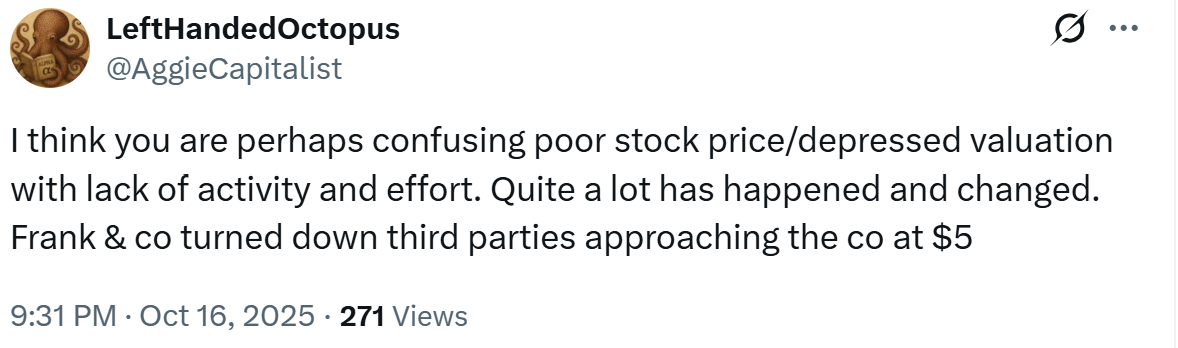

Then this tweet surfaced from the founder of Voss Capital:

"There were prior offers over $5."

— Voss Capital Founder

This is not the first time Voss Capital has expressed views on Thunderbird's value that conflict with the current deal.

In March 2021, Voss Capital published a blog post on Thunderbird Entertainment titled "The Animation Boom." In that post, Voss wrote that it thought "the path to a >200% return for TBRD is very possible" over the next two years. The stock closed that day at $4.14 per share.

"we think the path to a >200% return for TBRD is very possible over the next two years."

— Voss Capital, March 2021 blog post

A 200% return from $4.14 would imply a target price of over $12 per share — more than 6x the current $1.77 equivalent deal value.

If Voss believed prior offers exceeded $5/share, and previously thought the stock could reach over $12/share, how did it justify supporting a $1.77 equivalent deal?

Reasonable questions for a professional investor:

- Did Voss pursue competitive alternatives?

- Did Voss push for an auction?

- Did Voss evaluate Blue Ant's illiquid stock risk?

- Did Voss act in alignment with maximizing the value of other people's money?

No accusations — just questions shareholders deserve answers to.

Thunderbird Pulled Financial Guidance. Days Later, It Agreed to Sell. Coincidence?

Thunderbird withdrew its financial guidance shortly before the Arrangement Agreement was executed.

This sudden shift raises important concerns:

- Did the guidance withdrawal lower expectations and justify the Blue Ant price?

- Did the special committee receive updated projections?

- Were shareholders given a full and fair picture of Thunderbird's trajectory?

- Was this timing influenced by deal negotiations?

Shareholders deserve answers — but haven't received them.

37% of Shares Were Locked Up Before You Ever Saw the Deal

Thunderbird directors, executives, Voss Capital, Frank Giustra, Pacific Reach, and others holding ~37% of all shares signed Voting Support Agreements on November 25 — before the deal was announced and before shareholders saw anything.

These agreements require them to:

- Vote FOR the Blue Ant deal

- Vote AGAINST ANY superior proposal

- Not revoke their vote under any circumstances

- Stop all conversations with other bidders

- Report any alternative approach to Blue Ant within 24 hours

- Not dissent

- Not speak publicly without Blue Ant's permission

Shareholders "shall vote… in favour of the Arrangement" and "against any… Acquisition Proposal."

— Voting Support Agreement

This is not a free vote.

It is a pre-loaded outcome — unless the remaining shareholders stop it.

Before Trusting Blue Ant's Founder, Look at His Last Exit

Michael MacMillan built Alliance Atlantis and sold it in 2007 for $2.3 billion.

What happened afterward?

- Alliance Atlantis was acquired by Canwest + Goldman Sachs

- Canwest collapsed under the debt load (2009)

- Assets were transferred to Shaw Communications

- Shaw later divested them to Corus, which subsequently entered severe decline

Not MacMillan's fault — but the pattern is instructive:

MacMillan exits at peak → buyers struggle → long-term shareholders take the hit.

Blue Ant appears to be his second attempt at building a media empire.

Thunderbird shareholders should not become collateral damage in Act II.

Blue Ant Doesn't Build Media Assets. It Churns Through Them.

Blue Ant has a decade-long pattern of:

- acquiring companies,

- integrating or resizing them,

- then selling, shutting down, or repositioning them.

Documented history:

Early acquisitions

- High Fidelity HDTV → absorbed

- Cottage Life → restructured

- GlassBox → absorbed

Digital bets

- Omnia Media → rebranded → pruned

- MobileSyrup → sold

- Animalogic → sold

- Other digital assets → discontinued

International

- NHNZ → majority stake later sold

- Beach House Pictures → sold to Fremantle

- ZooMoo & Asian channels → sold in 2020

Boat Rocker RTO

- Blue Ant acquired distribution assets

- Boat Rocker Studios was carved out and kept by management

- Blue Ant refused the studio business and is now trying to buy Thunderbird's instead

Pattern: Blue Ant does not keep what it buys.

It repackages and divests.

Thunderbird is a studio — the exact type Blue Ant historically has not held onto.

The Only "Premium" Is Against a Depressed Price

Yes — the offer shows a headline premium to the day-before closing price.

But that price was:

- suppressed by the sudden withdrawal of guidance,

- affected by low liquidity during the strategic review,

- unreflective of intrinsic value, and

- far below prices where Thunderbird traded earlier in the year.

This deal:

- Offers no premium to where the stock traded 12 months ago

- Offers no premium to precedent animation studio valuations

- Offers a massive discount to reported prior interest "over $5/share"

- Ignores Thunderbird's growth and pipeline value

A real premium rewards long-term shareholders.

This deal simply rewinds the price to stale levels.

Read This Before You Vote — The Deal Structure Tilts Hard Against Shareholders

1. No Go-Shop Clause

Thunderbird is prohibited from seeking alternative bids.

- There was no auction.

- No competitive tension.

- No outreach to prior interested parties.

2. Voting Agreements Block Consideration of Superior Offers

Major shareholders must:

- Vote against any superior bid

- Stop all alternative discussions

- Report any inbound inquiry to Blue Ant

- Continue supporting the deal regardless of new information

This structure could severely limit the board's ability to extract maximum value.

We are not alleging misconduct — but the constraints raise legitimate questions about whether directors could fully discharge their duty to seek the best outcome.

3. Cash Pool Cap → Forced Stock

Cash elections are capped at $40M.

If oversubscribed:

- You will be prorated

- You will receive Blue Ant shares

- You cannot know the allocation in advance

This is not shareholder-friendly.

4. Governance Inversion

Thunderbird shareholders lose:

- voting power

- influence

- governance rights

- strategic control

Blue Ant's founder controls the combined company.

Thunderbird holders get subordinate voting shares.

5. Termination Fee ($3.56M)

Approximately 4% of the deal value.

High enough to discourage competing bidders.

Blue Ant's $7 Million in "Savings" = Thunderbird Job Losses

Blue Ant is lean.

Thunderbird is not.

To achieve "synergies," cuts will fall on:

- Atomic Cartoons

- GPM

- Support staff

- Production management

- Corporate services

You cannot cut your way to creativity —

but you can cut your way to broken production pipelines.

Tell Us Why YOU Are Voting NO

Share your story. Your voice matters.

Make Your Voice Count: Vote NO on the Blue Ant Arrangement

Proxy Instructions

When you receive your proxy materials:

- Mark NO or AGAINST on the arrangement resolution

- Do NOT leave it blank — blank votes may be counted as FOR

- Sign and return your proxy by the deadline

Broker Instructions

If your shares are held with a broker:

- Contact your broker directly

- Explicitly instruct them to vote NO

- Do not rely on default settings

- Get confirmation in writing

Critical: The 66⅔% Threshold

They need 66⅔% of votes CAST to approve the deal.

This means low turnout helps Blue Ant.

Every NO vote reduces their margin.

Your vote can stop this takeunder.

Read the Documents They Weren't Hoping You'd Read

Voting Support Agreements

See how 37% of shares were locked up before the deal was announced (annotated)

Document Coming SoonArrangement Agreement

Full terms of the deal with highlighted problematic terms

Document Coming SoonMaterial Change Report

Management's disclosure of the transaction (excerpts)

Document Coming SoonGovernance Comparison

Thunderbird vs Blue Ant voting rights and control

Document Coming SoonFairfax Bailout Details

How Blue Ant was financially engineered

Document Coming SoonThunderbird Deserves Better. Vote NO.

A NO vote:

- reopens the process,

- enables real bidders to emerge,

- forces the board to pursue true value,

- protects Thunderbird's creative engine and employees, and

- keeps control in YOUR hands, not Blue Ant's.

Protect your investment.

Protect Thunderbird's future.

Vote NO.